CONTEXT

The paper leaflet is a major strategic issue. It has always been appreciated for strong impact, offering an unparalleled range of promotions, with catalogs of up to 40 pages and 25 items per page. For customers, this medium offers the longest life span and a high rate of repeat reading. However, due to new restrictions across the European Union? enforcing “Yes Ad” stickers, retailers face an ultimatum. These changes happen in the middle of an inflationary period (in the UE, food inflation reached 10.6% in August 2022). Since September 1, 2022, in 13 French territories, retailers can no longer distribute leaflets to mailboxes that do not have the “Yes Ad” sticker. The Netherlands, Belgium and German have also applied the GDPR logic (based on opt-in) to advertising leaflets. Retailers must define a new media mix that reinforces their price image and generate traffic in stores.

MARKET OVERVIEW

..

Supermarkets are more advanced than specialised retailers. In France, Monoprix stopped using unaddressed leaflets at the beginning of 2019. At Auchan, digital and paper catalogs co-exist, but paper dominates. Carrefour, after a test conducted in four French cities, decided to stop the distribution of unaddressed leaflets in Paris and Lyon in January 2022. While Lidl started moving into digital before the Covid-19 crisis, Aldi is just starting. Specialised retailers are less dependent on paper promotional flyers, but are increasingly adopting a digital version. This is the case for Action (discount), Norauto (car equipment), ToysRUs (toys), SFR, etc.

Uneven maturity in Europe. While German and French consumers remain keen on a paper catalog, Dutch and Spanish shoppers are prepared to use digital media. For example, in Spain, Aldi rarely distributes paper catalogs. Online catalogs combined with weekly newsletters work well. On the other hand, for companies who distribute leaflets, the profitability of a market is linked to a territorial density. For them, Spain, Italy and France work well because of high urban population density. In Germany and in the U.S.A., there are no profitable leaflet distributors for such a widely dispersed population.

…..

KEY FIGURES

……

In 2021, in France, bland and non-addressed leaflets represented an average of 30 kg per household, i.e., nearly 800,000 tons.

France: 17% of mailboxes have the “Stop Ad” sticker in 2020 (Ademe). Germany: 27% have “Stop Ad” in 2020 (Bonial).

Belgium: 19% have “Stop Ad” in 2020 (Bonial).

Amsterdam: 23% of households have the “Yes Ad” sticker on mailboxes, and identical for Rotterdam.

…

////

OPPORTUNITIES

….

Environmental commitment. The “Yes Ad” results from environmental legislations and aims to reduce paper waste. At Monoprix (Casino Group), the management decided to move to a “zero leaflet” strategy to gain customer support and loyalty. Comparative analyses between digital and paper show that energy consumption to make digital media, and therefore the CO 2 impact, of digital leaflets is significant. Creating videos considerably increases the CO2 impact.

…

The issue of rising costs. Paper catalogs have been popular for more than half a century and still represent around 50% of a typical marketing budget at a typical grocery chain. Readers will remember that a marketing budget typically represents up to 2% of sales, i.e., almost all EBITDA. In 2022, costs of paper leaflets increased sharply between 30% and 50% (source: interviews conducted by mind Retail). In addition, distribution costs are much higher than those of a digital version, because there are now fewer “opt-in” mailboxes in a given area. According to the UFIPA, the price of paper pulp also jumped by 60% at the end of 2021 due to the growing demand from e-commerce (parcels) and food industry players (replacement of plastic packaging). The measured R.O.I. of paper catalogs has dropped and retailers are co-existing with both paper and digital leaflets, which are distributed on Google, Facebook, WhatsApp or Messenger by e-mail or digital platforms.

….

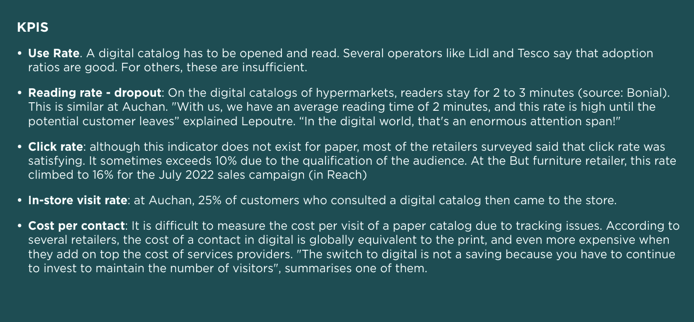

Performance measures. Digital catalogs allow better performance results, thanks to the wide range of associated data, including reading rate, reading time, most read products, conversion rate into visits and conversion into a sale. According to Mathieu Lepoutre, Head of Media at Auchan Retail, the digital catalog allows a better understanding of the user experience of a leaflet. “With paper leaflets, we have little data on page views, while in digital, we can understand what happens before and after, or when customer attention (and a potential sale) is lost”.

…

Personalization. With digital, retailers can now replace a mass medium with a personalised one. They can format messages and promotions that fit a customer profile. “However, promotional leaflets aim to create impulse purchases, to deprogram customers and make them buy what they had not planned”, explained the Media Director of a specialised retailer. Several executives interviewed by mind Retail believe that, in the future, catalogs will be increasingly adapted to each customer. “Originally, a leaflet was used to sell unusual products to unusual customers,” said Frederic Preslot, Operational Marketing Director at Carrefour. “When you have 8-foot basketball hoops on sale, there’s no way that’s going to be on the shopping list”. With digital leaflets, the exposure of unusual products becomes an

issue of paid communication and paid reach.

….

Reactivity. The flip-through, or digital swipe of a PDF offers more flexibility in meeting customer demand. It allows the addition of last-minute promotions, impossible during the printing of a paper catalog.

.;;.

Customer relationship. Retailers are pulling several levers at the same time. For example, they target high value mailboxes with a paper leaflet (“opt-in” due to “Yes Ad”) and make digital complements for a different audience. The digital flexibility of a catalog allows a richer range of formats and ways of communication. These include digital discount coupons usable via a smartphone, discussions via WhatsApp and Messenger or geo-location digital advertising. For high peak promotional periods like Christmas or Wine Fairs, some plan to send paper leaflets to their “opt-in” customers,

despite higher associated costs. Carrefour offers a “Click to Buy” scheme, which allows customers to buy directly from the digital leaflet, but this does not generate store visits. Whilst specialised retailers have adopted this technology for a while, it is starting to arrive at supermarkets.

….

Overcoming a generation conflict. Internally, this topic illustrates the clash between old school people and the younger generation who are innovators. “Young executives who come from e-commerce teams may have a certain disdain for digital PDF formats to swipe,” explained a Digital Director. “In reality, what seems ‘cool’ and innovative is not always what works best. What may seem ‘old-fashioned’ continues to work. In the end, the judgement always lies with a customer”. Internally, organisations are shifting. Previously, a paper leaflet process was managed by marketing teams with a very local prism, whereas media and digital teams had a

more national prism. Today, they collaborate. The CMO orchestrates a three-way conversation with CRM, digital and operational communication. This imbalance can also be found in agencies. Many specialise in digital, others in local, but few are able to handle a hybrid campaign over both dimensions.

;;..

THE CHALLENGES

….

Customer typology. Carrefour’s preliminary pilot showed that urban customers were more digital oriented than those living in rural areas, who remained very attached to paper leaflets. According to the company, many “promotion addicts” customers have already switched to digital and are not affected by the end of paper. However, irregular customers are more at risk, as they often live near another retailer’s store that continues to solicit them with the traditional leaflets. Where consumers are older, they are less comfortable using digital leaflets. “There is no single timing or formula for replacing paper”, adds Preslot, Operational Marketing Director at Carrefour. “We have to take into account the differences in maturity between urban and rural consumers, and between young and old”. At Lidl, too, “we have exceptional results with younger people,” said a former executive. Strengthening price image. In retail, market share gains are achieved through voice media share and price and promotional image. However, amid an inflation period, the need for promotions is more important today than a year ago, and reinforcing a strong price reputation is highly strategic. How can retailers combine digital marketing with the ability to broadcast locally? With “Yes Ad”, will we see a return to fixed media like billboards?

..

Reach. For retailers, the challenge of Reach is huge. For the moment, a digital catalog has a limited readership. “With a paper leaflet distributed to 15 million mailboxes, 15 million households were saw 500 or 100 offers per week,” summarised Laurent Landel, C.E.O. of Bonial. “Retailers want to be sure to find this firepower in digital”. The challenge is to know which digital solution ensures this reach. It is therefore necessary to be present on all media formats. As it becomes more and more expensive to add the recruitment cost with paid options, stores must take over. “With the end of a paper catalog, the “Reach” is no longer just a CRM issue”, explained Frederic Preslot from Carrefour. “It is also becoming a store issue, and the stores must now actively participate”. At Auchan, in order to increase a consumer base, e-mail addresses are collected in stores via game terminals, but the firm also invests in paid Reach. To contact consumers who have not given a formal “opt-in”, the company offers “opt-in” routes via Facebook Messenger and WhatsApp.

….

….

NEXT FRONTIERS

…

Enhance consultation of digital catalogs. If the first level consists in informing customers that digital leaflets exist (via display in store, QR code on the carts), it is important to ensure they then read a digital catalog. For example, Auchan offers a fridge magnet to help scan promotional leaflets. For those who didn’t stick the “Yes Ad” sticker on a mailbox, they request a catalog via e-mail or WhatsApp. On the Carrefour’s website, consumers can choose how they want to receive leaflets, including e-mail, SMS, WhatsApp, and physical post. Offering benefits to digital adoption. Retailers have to offer incentives to foster adoption of a digital catalogue like price coupons and digital-only promotions.

New features. Optimizing the UX of the digital catalog is everybody’s priority. Beyond browsing, retailers sort the offers by categories (drinks, groceries, electronics). At Auchan, a customer can personalise their own leaflet. By clicking on their five favorite product categories, the leaflet unfolds in that order, reconfigured just for them. Finally, if creating a leaflet is instinctive, there are many other ways to do so. At Lidl UK, the offer is displayed from top to bottom with other ways of promoting the products. This is a very innovative model, free from the constraints of print.

….